Goodbudget is a popular Android app that has gained recognition for its effective budgeting and personal finance management capabilities. With over a million downloads on the Google Play Store and a high user rating, Goodbudget has become a trusted tool for individuals and families seeking to take control of their finances. In this article, we will delve into the key features and benefits of the Goodbudget Android app.

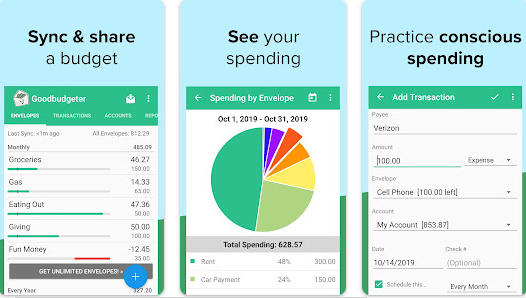

Budgeting is at the core of Goodbudget’s functionality. The app employs the envelope budgeting method, a time-tested strategy that helps users allocate their income into specific categories or “envelopes” for different expenses such as groceries, rent, entertainment, and savings. Users can create and customize these envelopes to suit their unique financial goals and priorities.

One of the standout features of Goodbudget is its simplicity and user-friendly interface. Even individuals with little to no experience in budgeting can quickly grasp how to use the app. The straightforward design allows users to create, manage, and track their budgets effortlessly.

Goodbudget offers both free and paid versions, making it accessible to a wide range of users. The free version comes with essential budgeting tools, while the paid version, known as Goodbudget Plus, offers additional features such as syncing across multiple devices, unlimited envelope creation, and priority customer support. This tiered pricing structure ensures that users can choose the plan that best suits their needs and budget.

Syncing is an essential aspect of Goodbudget that enhances its usability. With Goodbudget Plus, users can sync their data across multiple devices, ensuring that they have access to their financial information wherever they go. This feature is particularly valuable for families who want to collaborate on budgeting and stay on the same page when it comes to managing their finances.

Goodbudget promotes financial transparency and collaboration within households. Multiple users can access and contribute to the same budget, allowing families to work together towards their financial goals. This real-time collaboration feature fosters communication and accountability, reducing financial conflicts and promoting financial harmony.

The app also provides insightful reports and visualizations that help users gain a deeper understanding of their spending habits and financial trends. These reports include graphs and charts that illustrate income, expenses, and savings over time, making it easier to identify areas for improvement and adjustment.

Goodbudget takes security seriously, ensuring that users’ financial data remains safe and private. The app uses bank-level encryption to protect sensitive information, and users have the option to set up a PIN or use biometric authentication to access their accounts. This commitment to security gives users peace of mind when entrusting their financial data to the app.

Another notable feature of Goodbudget is its ability to import transactions directly from users’ bank accounts. This automated transaction tracking saves users time and reduces the risk of manual data entry errors. By linking their bank accounts, users can effortlessly reconcile their budgeted amounts with actual spending, helping them stay on top of their finances more effectively.

In conclusion, the Goodbudget Android app offers a powerful yet user-friendly solution for budgeting and personal finance management. With its envelope budgeting method, synchronization capabilities, collaboration features, and strong emphasis on security, Goodbudget provides users with the tools they need to take control of their finances and achieve their financial goals. Whether you’re an individual looking to manage your expenses or a family striving for financial harmony, Goodbudget is a valuable tool that can help you navigate the complexities of personal finance with confidence.