In the era of digital transformation, financial technology (FinTech) companies are continuously innovating to simplify and enhance the way people manage their finances. One such groundbreaking innovation is the Slice UPI Card Credit Android App. This app has emerged as a game-changer in the world of digital payments by seamlessly blending the convenience of credit cards with the flexibility of UPI payments. In this article, we will explore the key features and benefits of the Slice UPI Card Credit Android App, shedding light on how it is revolutionizing the way we transact and manage our finances.

Slice UPI Card Credit Android App: A Brief Overview

The Slice UPI Card Credit Android App is a digital payment and credit management platform that empowers users to make payments, access credit, and manage their financial affairs with ease. Developed by SlicePay, a leading FinTech company, this app has gained immense popularity in India and beyond. It has effectively bridged the gap between traditional credit cards and UPI payments, offering users the best of both worlds.

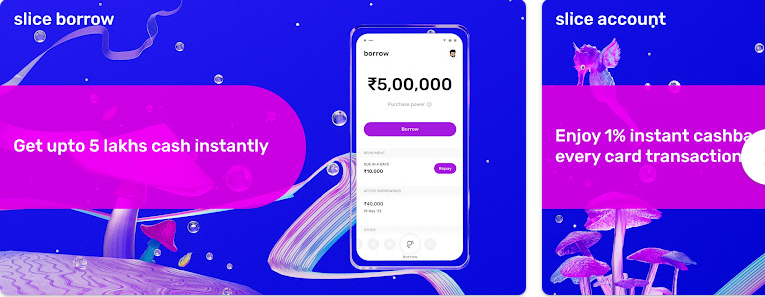

The app provides users with a virtual credit card that can be used for online and offline transactions, just like a physical credit card. This virtual card is linked to the user’s UPI ID, making it easily accessible and usable for a wide range of transactions.

The integration of UPI (Unified Payments Interface) enables users to make quick and secure payments to merchants and individuals. Users can also link their bank accounts directly to the app for seamless fund transfers.

Slice UPI Card Credit Android App offers a predefined credit line to eligible users. This credit line allows users to make purchases and payments even when they have insufficient funds in their bank accounts. Users can repay the borrowed amount in convenient monthly installments.

The app’s credit approval process is swift and hassle-free, with a focus on serving young adults and college students. It eliminates the need for lengthy paperwork and extensive credit checks, making credit accessible to a wider demographic.: Unlike traditional credit cards, the Slice app charges no annual fees or hidden charges. This transparency in fees makes it an attractive option for those looking for a cost-effective credit solution.

Benefits

- Financial Inclusion: Slice UPI Card Credit Android App has played a pivotal role in promoting financial inclusion by providing credit to individuals who might not have access to traditional banking services. It caters to the needs of students, young professionals, and others who may not have a credit history.

- Convenience: The app offers unparalleled convenience by allowing users to manage their credit and payments from a single platform. Users can track their expenses, view monthly statements, and make repayments effortlessly.

- Security: SlicePay places a strong emphasis on security, ensuring that user data and transactions are protected from unauthorized access. The app utilizes encryption and authentication protocols to safeguard sensitive information.

- Building Credit Score: Using the Slice UPI Card Credit Android App responsibly can help users build a positive credit history, which is crucial for future financial endeavors like loans and mortgages.

- Savings: The app also offers rewards and cashback on select transactions, helping users save money while making everyday purchases.

Conclusion

The Slice UPI Card Credit Android App is a prime example of how FinTech companies are revolutionizing the way we manage our finances. By combining the features of credit cards and UPI payments, SlicePay has created a platform that is not only convenient but also inclusive. This app has the potential to transform the financial landscape, making credit accessible to a wider audience and simplifying the payment process for millions of users. As the world continues to embrace digital payments, Sli